Contact Us

Tel:8625-84460835

Fax:8625-84466643

E-mail:ir@jsexpwy.com

Add: 6 xianlin road, Nanjing, Jiangsu province, china

Media Contact Wonderful Sky Financial Group

Tel:852-28511038

Fax:852-25981588

E-mail:prd@wsfg.hk

Add: 6/F Nexxus Building, 41 Connaught Road Central, Hong Kong

Shareholder returns

Investor Return Mechanism

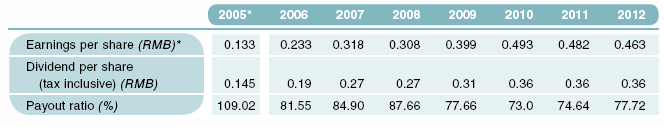

While achieving rapid development through the capital market, the Company also understands clearly that investors are the driving source for the development of the Company. The Company views bringing positive returns to shareholders as its important mission and business principle and strives to enable investors to better share the results from the development of the Company and guide investors to establish long-term investment and rational investment ideas for achieving a virtuous cycle of capital. The Company has set up a positive and stable dividend policy as set out in its Articles of Association, aiming to create higher returns for the shareholders. During the Reporting Period, pursuant to the" Notice on Further Implementing Issues concerning Cash Dividends of Listed Companies"(《關於進一步落實上市公司現金分紅有關事項的通知》) issued by the CSRC, the Company further improved its decision-making procedures and mechanism for cash dividend distribution and specified in detail the cash dividend policy by amending relevant terms in Chapter 18 Profit Distribution of the Articles of Association.Since its listing, the Company has been maintaining a positive stable mechanism for shareholder returns and paying cash dividends for 16 consecutive years. At the end of 2012, the Company had distributed an aggregate of RMB15.498 billion cash dividends, with average payout ratio reaching 75% and accumulated dividend per share amounting to RMB3.0817, thus enabling shareholders to enjoy good returns from the development of the Company. According to a research report released by the China Center for Market Value Management, the Company ranked first among all the A-share listed companies in terms of shareholder returns due to its high payout ratio over the years.

In 2012, the Company distributed a cash dividend of RMB0.36 per share, equivalent to approximately 87.4% of its distributable profit (based on the amount of net profit after transferring 10% to statutory reserve) for the Year, and the payout ratio reached 77.72%.

- Earnings per share refer to the basis of profit for distribution of dividends.

- This refers to the special dividends for the distribution of the unappropriated profits of the Company for the year 2005.

Ensuring a long-term and stable return for shareholders remains the top priority of the Company. Taking into account both the long-term benefits and current income of its investors, the Company will maintain a stable dividend policy in the coming years.